"The Bank uses cookies to improve your online experience. By continuing to use the website we assume you are happy to allow the use of these cookies. Take a look at our Cookie Policy to learn more and change your preferences."

DCB Remit, powered by DCB Bank, is an online platform which allows you to send money abroad to a foreign bank account, completely online.

customers

branches

states

union territories

Invite a friend and get free money transfers for 3 months

Nothing makes us happier than hearing how happy we made you

It is extremely easy to register and perform transactions on the DCB Remit portal. I had a no hassles and would definitely recommend others to try it too.

My DCB home branch was extremely cooperative when I was registering for the platform. Once I had registered, using the online portal was a very smooth experience.

A very easy-to-use & convenient service provided by DCB Bank. DCB Remit has a user friendly interface which makes operating the portal effortless.

My experience of using DCB Remit was excellent. The ease of use made possible by the user friendly interface was superb.

DCB Remit is a very nice platform especially because the interface is so easy to follow that I registered without anyone's help. I'll surely recommend DCB Remit to everyone.

Get your queries resolved here.

Give us a missed call at

Email us at

DCB Remit is online and exclusively for eligible resident Indian bank account holders to remit money abroad from India . Be it from the comfort of the home, office, any time of the day or night enjoy the comfort and experience of DCB Remit provided by DCB Bank.

Any resident Indian bank account holder across India can use DCB Remit and transfer money abroad from India. We provide quick, reliable and secure remittance facility. Whether you want to support your loved ones or invest in their education abroad, trust DCB Bank to facilitate your international money transfer from India with efficiency and peace of mind.

DCB Remit is available for over 20 countries including USA, Australia, United Kingdom, UAE, Singapore, Canada, Germany, Austria, France, Italy, Malta, Netherlands, Belgium, Cyprus, Finland, Estonia, Ireland, Greece, Portugal, Slovakia, Slovenia, and Spain. DCB Remit supports 7 international currencies, namely USD, CAD, SGD, AUD, GBP, EURO and AED.

DCB Remit, an online outward remittance service, enables remittance for permissible purposes such as, overseas education, family maintenance, gifting, private visits, business travels, medical expenses, emigration or visa fees. The eligible and permitted use must adhere to RBI guidelines and circulars, such as Liberalised Remittance Scheme (LRS) amongst others and applicable Indian laws.

Peace of mind money transfers: No physical document submission. Our process is completely digital for quick online remittance.

Superior rates: Take advantage of the superior foreign exchange rates.

Time-saving is big: Bid farewell to the wait times at your bank's branch. Try our digital platform, it saves your valuable time-no need to visit any bank branch or money changer.

Security: We use safe and effective techniques to protect your transactions.

Real-time tracking: Get up-to-date information on the progress of your transfer.

Transparency: No additional cost! We believe in transparency. There are zero transfer fees, with no commission or hidden charges.

Bank account flexibility: You can use this money transfer remit service without maintaining an account with DCB Bank. There are different payment options you can use to transfer funds from your resident Indian bank account to DCB Remit, such as NEFT, RTGS, IMPS or UPI. DCB Remit users can remit money from India up to USD 25,000 equivalent per annum and DCB Bank account holders can send up to USD 100,000 equivalent, towards family maintenance and for payment of tuition/college and university fees abroad.

Everyone wants a service that ensures their loved ones receive money quickly and easily. International money transfers from India isa simple process.

*Subject to fulfilment of compliance due diligence and complete online submission of all details and information as required by DCB Remit.

All charges (including government taxes) levied for money remittance will be displayed to you, along with the reason, on the DCB Remit website while you book the transaction.

| Foreign Exchange Transfer Amount in ₹ Charges in ₹ | Charges in ₹ |

|---|---|

| ₹ 1 <= ₹1,60,000 | ₹ 1 per Thousand* |

| Above ₹ 1,60,000 | 0 |

Dear customer,

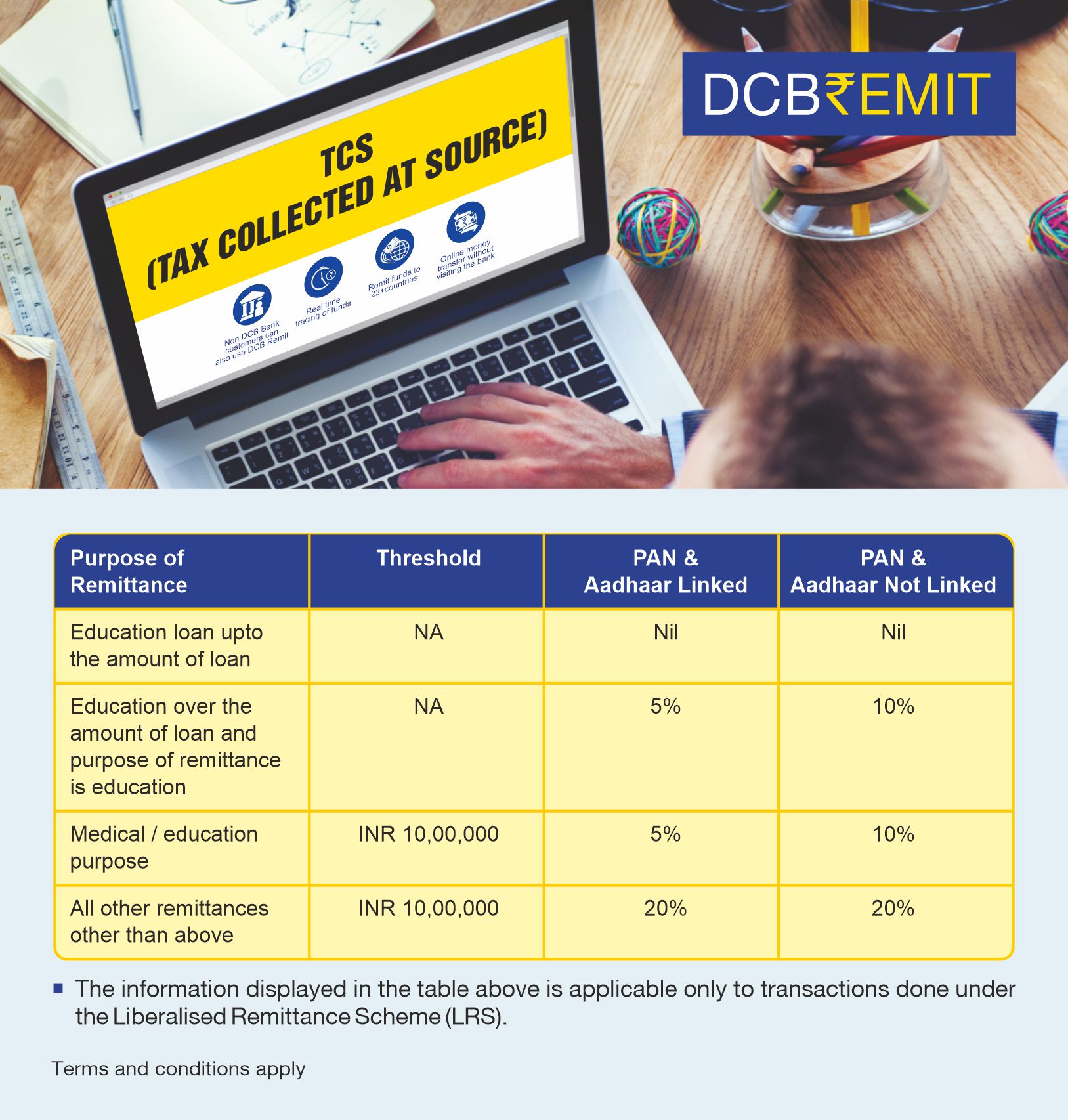

As per the amended section 206C(1G) of the Income Tax Act 1961, Tax Collected at Source (TCS) rate will be revised with effect from 1st April 2025. Also, non-linking of Aadhaar with Permanent Account Number (PAN) will attract higher TCS with effect from 1st April 2025. Therefore, please link your PAN with your Aadhaar. To check the status of the linkage of your PAN with Aadhaar, visit https://eportal.incometax.gov.in/iec/foservices/#/pre-login/link-aadhaar-status

For details on the procedure to link PAN with Aadhaar, visit https://eportal.incometax.gov.in/iec/foservices/#/pre-login/bl-link-aadhaar.

To understand the applicable TCS rates with effect from 1st April 2025. Please click here TCS CALCULATION